Quant investing: What is Quant Fund Many investing strategies are included in Quant investing. In this, the process is completely automated, and all the investment decisions are taken on the basis of the investment strategy already decided in the computer. (Jagran Graphics)

What Is Quant investing

Credit: Google

You must have heard about mutual funds in the stock market. Generally, these are of two types first active mutual fund and second index fund. But in today’s time, another category of mutual funds is emerging rapidly, namely Quant Funds.

What are Quant Mutual Funds?

In a typical mutual fund scheme, there is a manager who decides on the buying and selling of the entire assets of that fund. Whereas, Quant Mutual Fund is slightly different. The decision to buy and sell in this fund is taken with the help of a fully automated system. However, even in quant funds, there is a manager and his work is limited to monitoring the fund, designing the portfolio, and building automated systems.

Quant Investing is a term that covers a wide range of investing strategies. This is part of high-frequency trading.

Performance of Quant Funds

Currently, Quant funds are fairly new and most of these types of funds exist in the form of PMS and AIFs. For this reason, it will be difficult to say anything about its returns in the long term.

Quant funds are recognized globally and their size has crossed one trillion dollars. It is still in its initial stage in India.

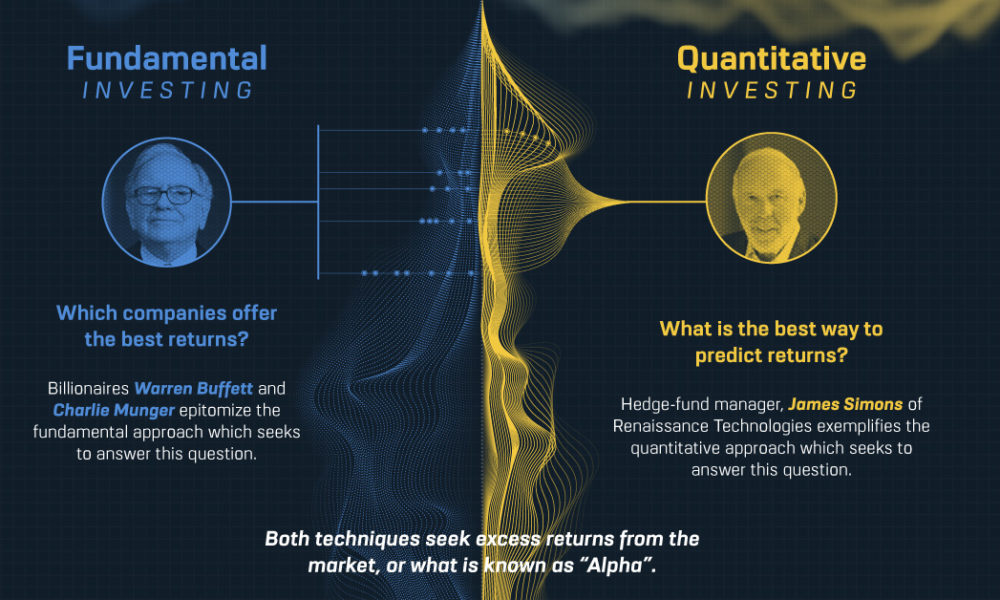

What is quantitative investing?

Quantitative investing, often called systematic investing, refers to adopting investment strategies that analyze historical quantitative data. You can conduct data analysis and use advanced models to calculate probabilities and identify the optimal moment to make profitable investment transactions.

Which investors are Quant Funds Investing for?

In Quant Investing, investing is done on a systematic basis. The decision taken in this is free from the bias of the fund manager. Each Quant fund is created for a specific type of investor. Therefore, any investor should understand the complete investment strategy of the fund before investing in it.

Quant Investing Strategy?

A quant investing strategy is an advanced mathematical model developed by industry professionals, including programmers, statisticians, and investment analysts. The purpose is to identify stocks with a higher probability of outperforming an index using a broad range of characteristics. Different models are available and may consider various factors, as we discuss in the next section below regarding different types of investing strategies(Quant investing).

Some common quant investment strategies:

- Quantitative value strategy uses all the information in a company’s income statement and balance sheet. The model calculates an aggregated score and ranks equities;

- Event-driven arbitrage refers to strategies that analyze data regarding events, such as changes in regulations, corporate actions, and more. Buying and selling transactions occur if the model establishes a specific pattern in price movements;

- Risk parity funds refer to the concept that gains in one asset class offset losses in another asset class. This strategy may improve risk-adjusted returns over a long period;

Passive investors use smart beta strategies (i.e., in mutual funds or ETFs) to improve the risk-adjusted returns using other factors than the market cap; - Statistical arbitrage seeks to identify misplaced securities using the relationship between them. This strategy often employs financial ratios to open short and long positions. It’s one of the active trading strategies;

- Investors initially used managed futures strategies on future markets to follow the major trends on the market. Nowadays, they have become more common in the stock markets, too;

- Factor-investing strategies use one or more factors that led to outperforming a benchmark index in the past. Some examples include growth, momentum, market cap, and value. The mathematical model scores each stock according to these factors and then uses the aggregate score to rank each of them;

- Systematic global macro strategies seek to identify countries and regions with favorable fundamentals. In other words, the model allocates the funds by analyzing the economy in various areas around the world;

- AI and big data strategies are the newest types of quant strategies. Generally, AI investing involves utilizing alternative data. Additionally, it is important to note that research has reported that machine-learning-based quant strategies tend to be more efficient than traditional quantitative investments.

- Multi-asset strategies refer to combining several different types of assets into one diverse portfolio. The types of assets could range from stocks and bonds to real estate or cash.

Also Read: Overnight the dice turned, Facebook’s Mark Zuckerberg gave Mukesh Ambani

Also Read: Apple CEO Tim Cook ate vada pav with Madhuri Dixit